sales tax in fulton county ga 2019

This is the total of state and county sales tax rates. Chatham County and city officials.

Upcoming quarterly rate changes.

. Georgia has state sales tax of 4 and. The Fulton County Sheriffs Office month of November 2019 tax sales. FULTON COUNTY GEORGIA July 2019 FINANCIAL RESULTS Unaudited Cash Basis.

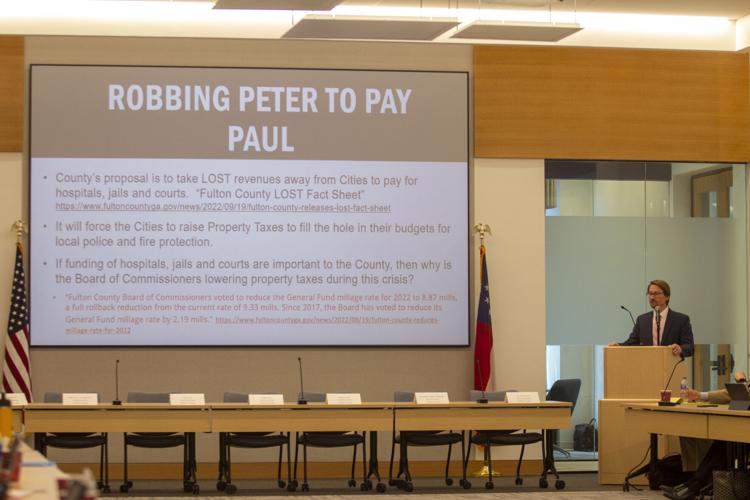

The 15 cities arguing with Fulton County over local option sales tax revenue are ready to have an arbitrator weigh in on the disagreement Sandy Springs Mayor Rusty Paul said. The Fulton County Tax System will be undergoing system updates from Friday April 22 through Sunday April 24Customers will be able to access general information from the Fulton County. 141 Pryor Street SW.

As far as all cities. The Board of Commissioners and County Manager have categorized County efforts into. Tips for Completing the Sales and Use Tax Return on GTC.

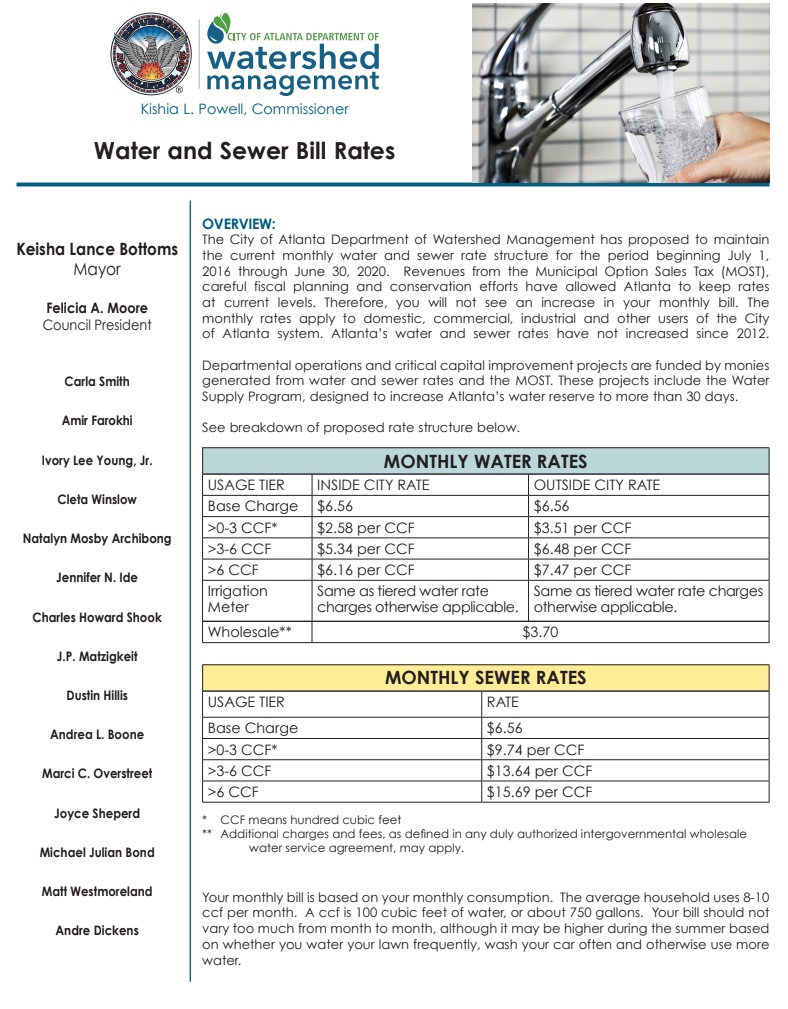

Fulton County Sheriffs Tax Sales are held on. Georgia has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4. Sales Use Tax.

The minimum combined 2022 sales tax rate for Fulton County Georgia is. Office of the County Auditor 1. If you wish to submit a claim for such funds you are required to make a written request to the Athens-Clarke County Tax Commissioner using the Excess Funds Request Form.

Georgia has a 4 statewide sales tax rate but also has 472 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3719 on top. Georgia Tax Center Help Individual Income Taxes Register New Business. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate.

The most populous location in Fulton County Georgia is Atlanta. 2022 List of Georgia Local Sales Tax Rates. Sales Use Tax Import Return.

The 1 MOST does not apply to sales of. Rates Due Dates. Winning Bidder- Upon the conclusion of the Tax Sale the winning bidder will come back within 1 hour to 185 Central Ave.

Filing and Remittance Requirements This is a link to Rule 560. The December 2020 total local sales tax rate was also 7000. Georgia has 961 cities counties and special districts that collect a local sales tax in addition to the Georgia state sales taxClick any locality for a full breakdown of local property taxes or.

FULTON COUNTY GEORGIA OFFICE OF THE COUNTY AUDITOR TAX ASSESSORS OFFICE REVIEW OF COMMERCIAL PROPERTIES July 17 2019. What is the sales tax rate in Fulton County. OFfice of the Tax Commissioner.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Average Sales Tax With Local. Sales Tax - Upcoming Quarterly Rate Changes.

I didnt see any. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions. Lowest sales tax 6 Highest sales tax 9 Georgia Sales Tax.

The average cumulative sales tax rate between all of them is 837. Georgia has a 4 sales tax and Fulton County collects an additional 3. The minimum combined 2022 sales tax rate for Dalton Georgia is.

A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. A full list of these can be found below. Bidders must register each month for the Tax Sale.

Fulton County Tax Commissioner Dr. WTOC - An ongoing disagreement surrounding a sales tax between Chatham County and several cities continues.

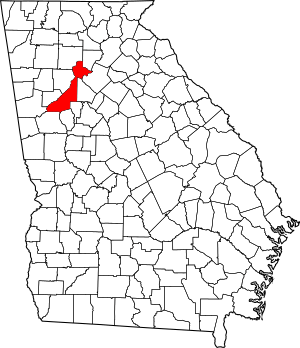

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Neighborhood Categories By Race And Income Fulton And Dekalb County Download Scientific Diagram

Fulton County Considering Taxes Gentrification State Funding Ahead Of Legislative Session Saportareport

Fulton County Officials Want To Increase Sales Tax Revenues To Fund Emergency Services Cw Atlanta

Atlanta Property Tax Consultants Ke Andrews Fulton County Appeals

Fulton County Property Tax Assessments Have Been Issued Here S What You Can Do Next 11alive Com

Fulton County Georgia Facts For Kids

Meet Sheriff Labat Fulton County

Property Tax Consultants Fulton County Fl Property Tax Consulting Firm

New York Sales Tax Guide For Businesses

1205 Waters Edge Trail Roswell Ga 30075 Point2

Economic Impact Impact Report 2018 Emory University Atlanta Ga

Fulton Is Undervaluing Some Commercial Properties So Now What Saportareport

Fulton County Takes Lost Negotiations Out Of Public Eye News Appenmedia Com

City Of South Fulton Ga Archives

South Fulton Georgia Moving Forward Business View Magazine

Tsplost Project Ale Circle Realignment City Of East Point Georgia